The income statement, also known as the profit and loss (P&L) statement, keeps financial records of a business. The income statement format in Bangladesh includes components such as sales, cost of goods sold, gross profit, operating expenses, operating profit, earnings before interest and tax, and net profit. Small businesses generally follow the single-step income statement format, while large businesses follow the multi-step income statement format.

What Is an Income Statement?

An income statement is one of the financial statements that shows a company’s income and expenses during a specific period, like a month, quarter, or year. It’s one of the three financial statements in the balance sheet. Through an income statement, we can know how a company’s revenue transforms into net profit or net income.

Components of an Income Statement in Bangladesh

The income statement format in Bangladesh mainly includes revenue, expenses, and net income. But there are more components that a company has to include for the varying operations.

Revenue Streams: Sales & Services

Revenue, sales, or service income are the fundamental components of a company’s income statement. It’s the total income generated from core business activities, like sales of goods and services.

Cost of Goods Sold (COGS)

Cost of goods sold (COGS), also known as cost of sales, is the costs directly involved with the sales of goods and services. It can for production or sourcing of the goods and services. COGS generally includes raw materials, manufacturing overhead, and labor.

Gross Profit

When we deduct the cost of goods sold from sales, we get gross profit. It’s the profit from the company’s core operations before it considers any operating expenses.

Operating Expenses

Operating expenses are the costs that a business incurs in its day-to-day operations. These include salaries, rents, administrative costs, marketing expenses, utilities, office expenses, wages, amortization, depreciation, insurance, etc.

Operating Profit (EBIT)

Operating profit, or earnings before interest and tax (EBIT), is the profit that a company gets by deducting its operating expenses from the gross profit. It’s the profit before the company considers any interest, tax, and other non-operating expenses.

Non-operating Income & Expenses (Interest Income, Penalties, Donations)

Non-operating income and expenses are involved with a business’s outer core operations. These are interest expense, loss or gain from sales of assets, interest income, income from investments, etc. Usually, the non-operating income and expenses are shown separately in an income statement.

Net Profit Before Tax (EBT)

Net profit before tax, also known as earnings before tax (EBT) and pre-tax income. It is calculated by deducting the non-operating profit from the operating profit.

Tax Expenses

As per National Board of Revenue (NBR) guidelines, a company has to include all tax payables in its income statement. So, the income tax expenses will include corporate tax, VAT, etc., which are to be deducted from earnings before tax.

Net Profit After Tax

After deducting tax expenses from earnings before tax, we get net profit after tax or net income after tax. Net profit makes up the retained earnings after deducting for dividends. This is then reported to a company’s balance sheet. Net income shows how a company is performing.

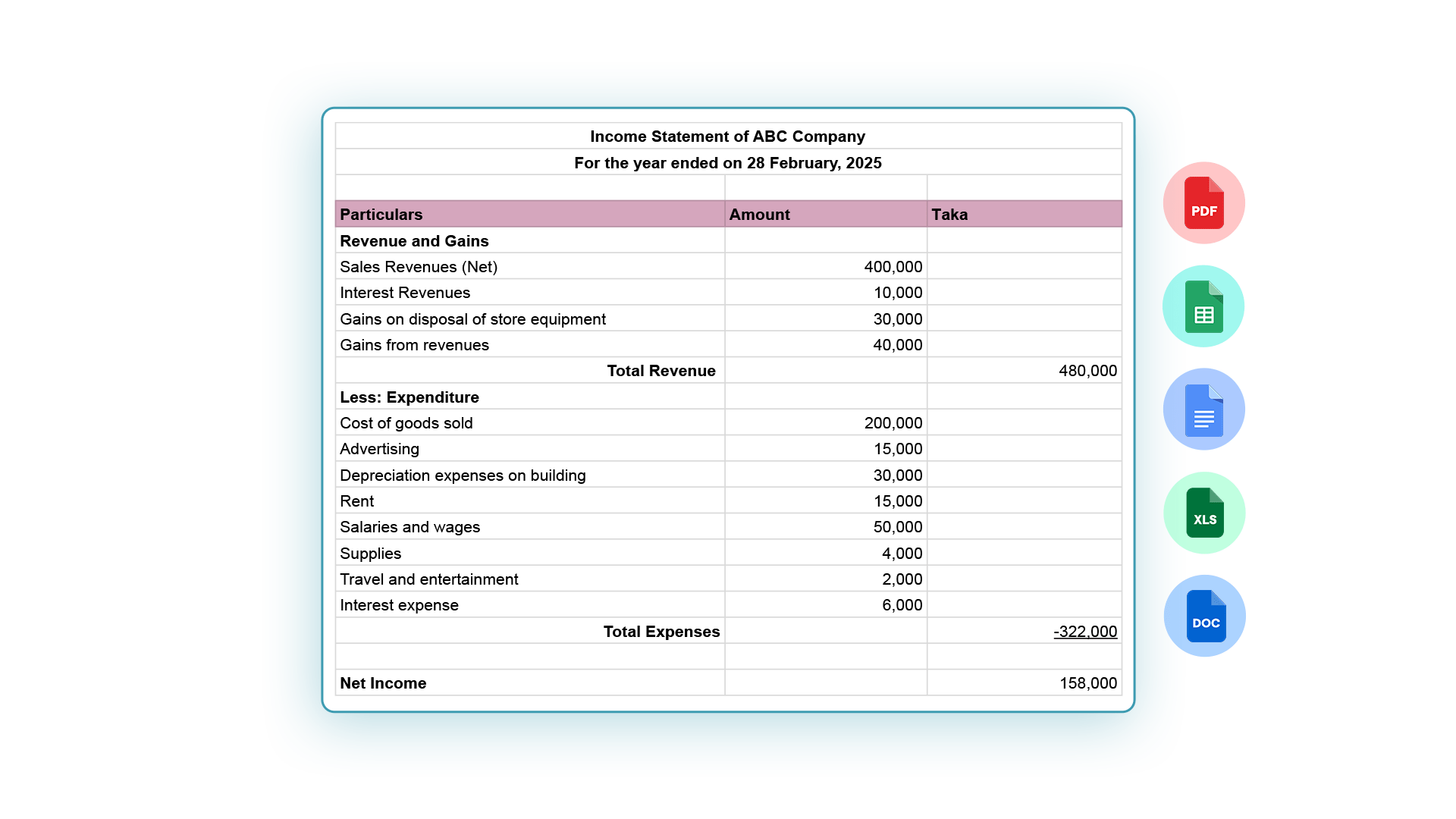

Income Statement Format In Bangladesh

There are income statement formats in Bangla and English, but this is the common format we follow:

Income Statement of XYZ Company

For the Year Ended April 30, 2025

| Particulars | Amount (Taka) | Amount (Taka) | Amount (Taka) |

|---|---|---|---|

| Sales revenue | |||

| Sales | 3,053,0810 | ||

| Less: Sales discounts | 242,410 | ||

| Sales returns and allowances | 564,270 | ||

| 80,6680 | |||

| Net sales revenue | 297,241,30 | ||

| Less: Cost of goods sold | 198,254,10 | ||

Gross profit | 989,8720 | ||

| Less: Selling expenses | |||

| Sales salaries and commissions | 202,6440 | ||

| Sales office salaries | 59,2000 | ||

| Travel and entertainment | 48,4400 | ||

| Advertising expense | 38,3150 | ||

| Freight and transportation-out | 41,2090 | ||

| Selling supplies and expense | 4,1720 | ||

| Postage and stationery | 1,7680 | ||

| Telephone and internet expense | 12,2150 | ||

| Depreciation of sales equipment | 45,0650 | ||

| 453,0280 | |||

| Less: Administrative expenses | |||

| Officers' salaries | 186,0000 | ||

| Office salaries | 810,000 | ||

| Office supplies | 52,620 | ||

| Legal and professional services | 237,210 | ||

| Utilities expense | 232,750 | ||

| Insurance expense | 70,790 | ||

| Depreciation of building | 180,650 | ||

| Depreciation of office equipment | 160,000 | ||

| Stationery, supplies, and postage | 30,000 | ||

| Miscellaneous office expense | 26,120 | ||

| 360,7710 | |||

| (803,7990) | |||

| Other Income and Expense | |||

| Interest Revenue | 98,5000 | ||

| Rental Revenue | 42,9100 | ||

| Gain on Sale of Plant Assets | 30,0000 | ||

| 171,4100 | |||

Income from operations / EBIT | 357,4830 | ||

| Less: Interest on Bonds and Notes | 126,0800 | ||

Earnings Before Tax | 231,4030 | ||

| Less: Income tax expense | 66,3490 | ||

| Net Income | 165,0490 |

Standard Income Statement in Bangladesh

In Bangladesh, the standard income statement follows the structure prescribed by Bangladesh Financial Reporting Standards (BFRS). Most businesses use the multi-step income statement format in the English language, while some of them use the Bengali language.

Difference Between Service and Trading Business Formats

Service businesses and trading businesses have some differences in their income statement format.

| Trading Business Income Statement | Service Business Income Statement |

|---|---|

| Sales is the main term in trading business income statement | Service income is the main term service business income statement |

| Includes cost of goods sold (COGS) | Doesn't include cost of goods sold (COGS) |

| Includes opening and closing stock | Doesn't include opening and closing stock |

| Often follows a multi-step format | Often follows single-step format |

Single-step vs Multi-step Income Statement

A single-step income statement is convenient for small businesses and a multi-step income statement is convenient for medium to large businesses. Let’s list both the formats’ differences.

| Single-step Income Statement | Multi-step Income Statement |

|---|---|

| All revenues and expenses are grouped together. | Has multiple sections for revenues and expenses. |

| Doesn’t include gross profit and operating profit | Includes gross profit and operating profit |

| Easy and simple to prepare | Comparatively more complex than single-step income statement |

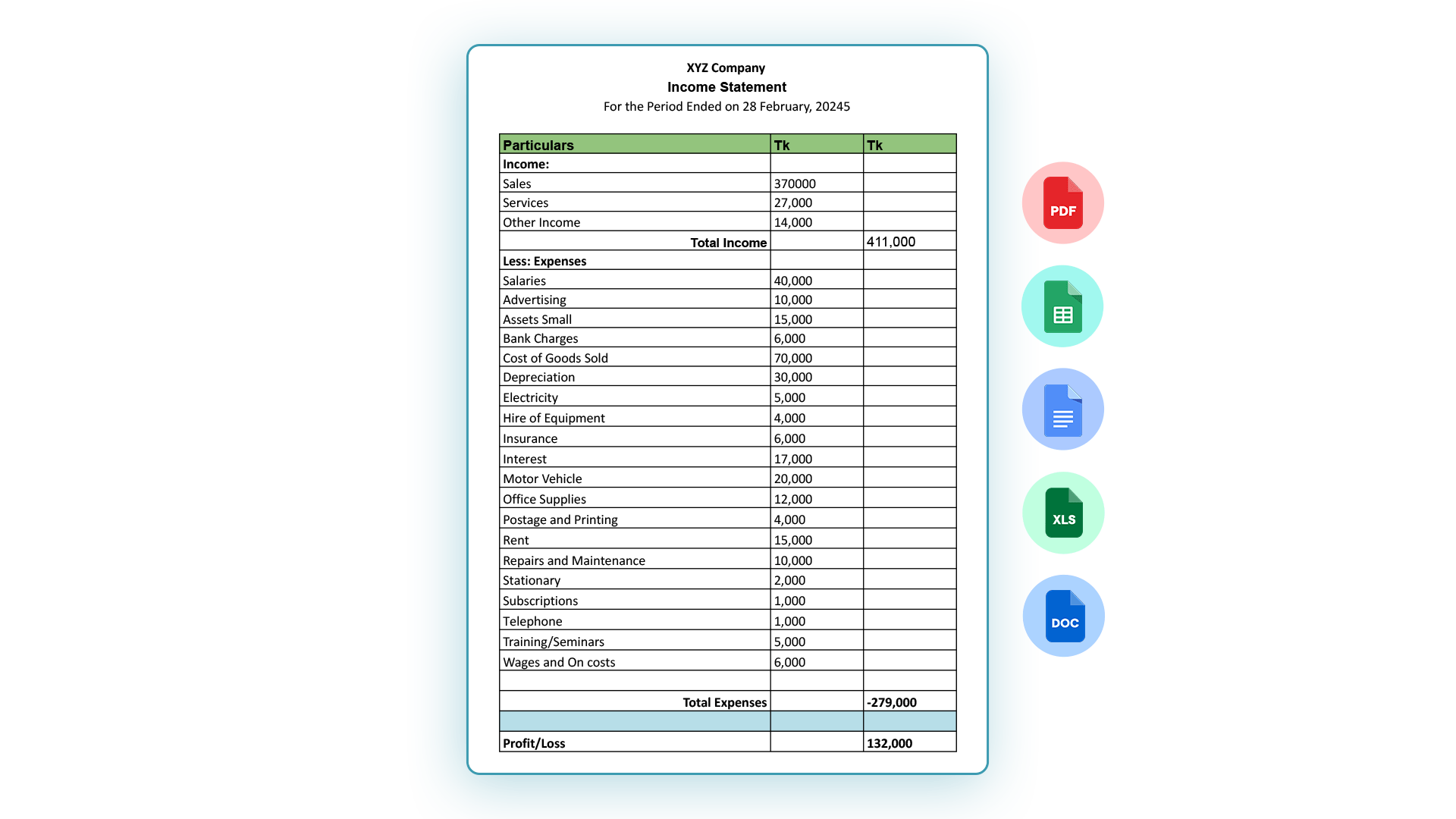

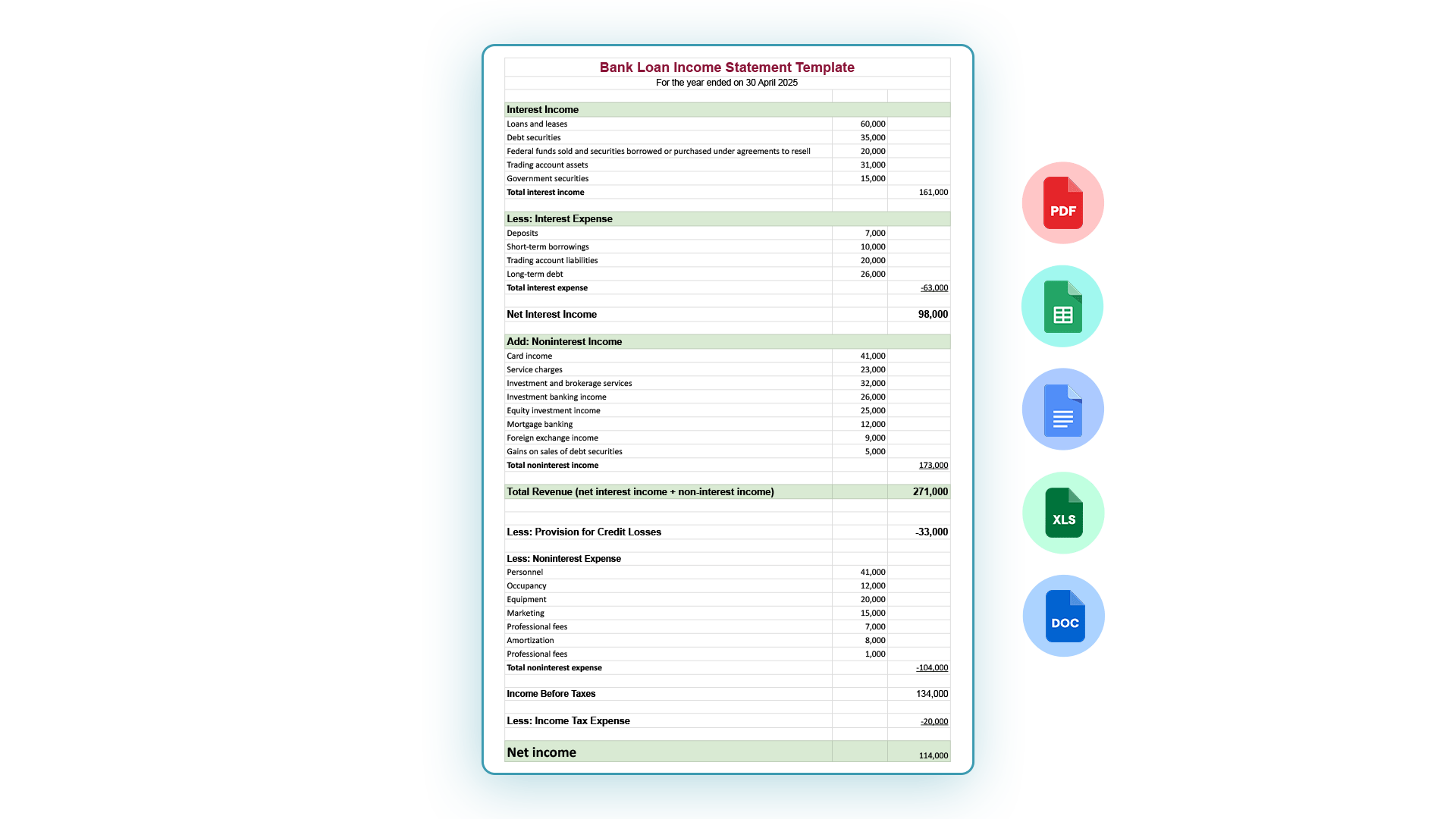

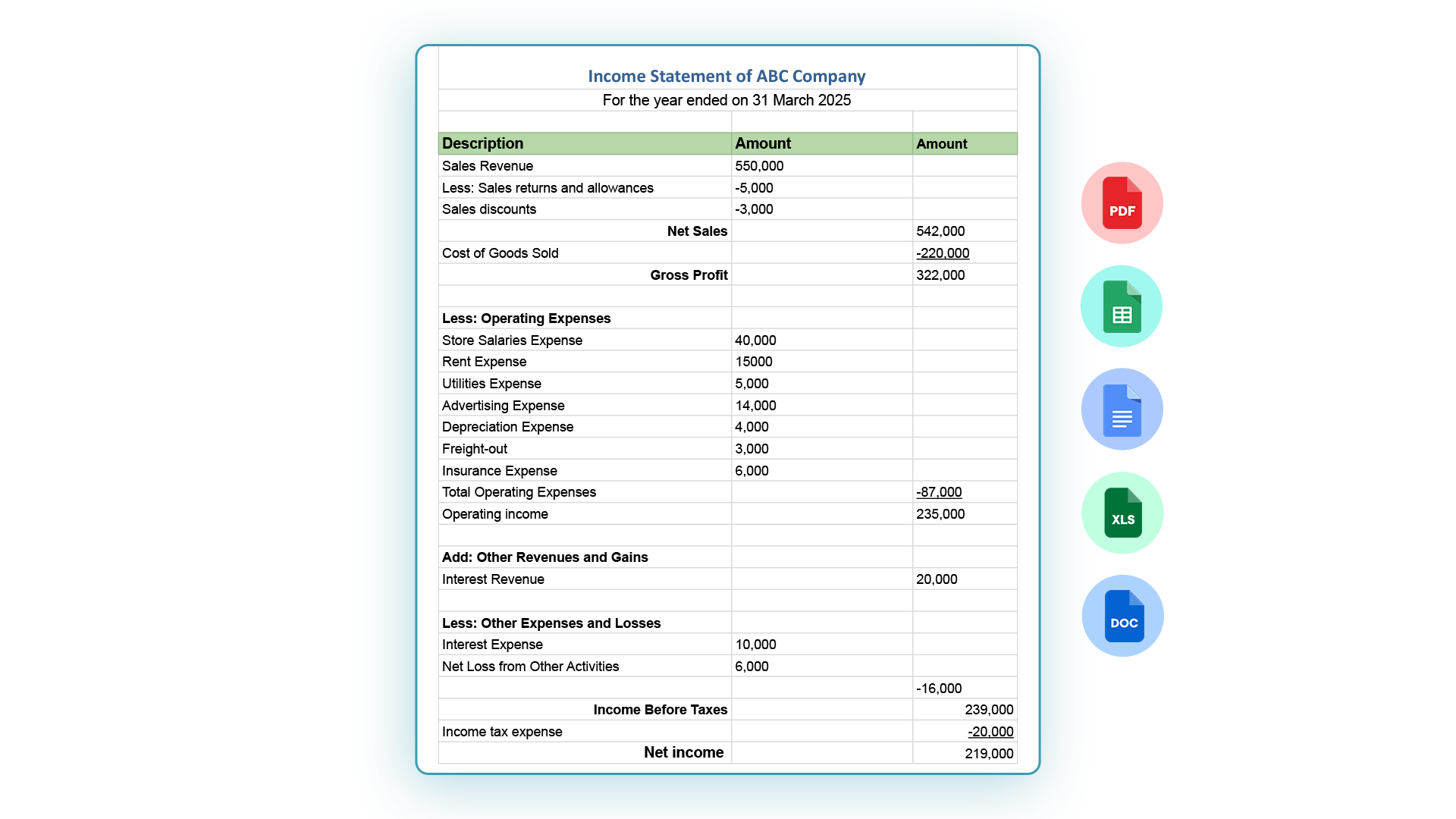

Download Income Statement Format in Bangladesh

Different businesses require different income statement formats in Bangladesh. Small businesses may opt for a single-step income statement format, while larger businesses typically require a multi-step income statement format for a more detailed understanding of their financials.

Income Statement Template for Small Businesses

Income Statement Template for Bank Loans

Multi-Step Income Statement Template

Single-Step Income Statement Template

How to Prepare an Income Statement in Bangladesh: Step-By-Step Process

To prepare an income statement in Bangladesh, follow the steps listed below.

Select Reporting Period (Monthly, Quarterly, Annually)

First, choose the reporting period of your financial statement. Most businesses record it monthly, quarterly, and annually. Go for an annual or quarter report if you want to spot the long-term trends with a higher-level analysis. And for quick insights, go for monthly reports.

Collect Sales and Income Records

Next, record all the sales and income records. This should include revenues from every line of a business. Also, you can record from the revenue line of the trial balance.

Determine COGS (if applicable)

Now calculate the cost of goods sold that your business incurred from selling the goods and services. These include direct labor expenses, material expenses, distribution costs, etc.

Calculate Gross Profit

Subtract the amount of cost of goods sold from net sales. Now you get the gross profit or the gross margin.

List and Subtract Operating Expenses

List all the operating expenses. These are the indirect costs of doing the business. Simply deduct the total amount of the operating expenses from the gross profit. Then you will get earnings before interest and tax (EBIT).

Add/Less Non-operating Items

Add the non-operating income and add non-operating expenses. These can be fine, investment income, etc. Add the non-operating profit or loss to EBIT.

Deduct Tax Based on Local Tax Laws

Now, deduct the interest charges and tax. To calculate the tax, multiply the applicable tax rate of Bangladesh by your pre-tax income figure. List it under the pre-tax income figure.

Finalize Net Profit

After deducting the income tax from the pre-tax income, we get net profit or net income. Don’t forget to add a header on the report and add your company’s details.

Pro Tip: Use Accounting Software

It’s very common to have mistakes and errors in an income statement report. But accounting software, like Financy can provide accurate financial reports to you. They automate recording and calculations while ensuring compliance with tax regulations and data security.

Common Mistakes in Income Statements

There are some common mistakes that often occur while preparing the income statement.

- Ignoring non-operating items: Companies can sometimes focus on core operations only, making them ignore the non-operating items. This will only lead to inaccurate profit margins.

- Incorrect tax deductions: Timing differences between accounting income and taxable income can result in incorrect tax deductions. This makes the company face issues with the National Board of Revenue (NBR).

- Misclassification of expenses: This can happen due to complex transactions, data entry errors and lack of clear guidance. It will distort the financial statement and create tax complications.

- Inconsistent reporting periods: The change in fiscal year and audit regulation changes can lead to inconsistent reporting. This will hinder the accurate comparisons of periodic financial reports leading to incorrect financial decisions.

Why Is an Income Statement Important in Bangladesh?

We get a clear picture of a company’s financial performance from its income statement. There is some more importance to it.

- Maintains accurate financial records by analyzing performance trends of the business at different periods.

- Measures business profitability by providing valuable insights into the business in various aspects.

- Helps in tax filing for NBR and determines tax obligations.

- Aids decision-making for SMEs and corporations, like budgeting, hiring, and expansions.

- Required for bank loans and investment pitches as a mandatory document.

- Preparing an income statement is essential for ensuring compliance with Bangladesh Financial Reporting Standards (BFRS).

Conclusion

By following the proper income statement format in Bangladesh, you can easily prepare a profit & loss statement that reflects your business’s financial condition. This will help you plan and set your financial goals for future operations. However, it’s obvious to make errors while preparing the income statement. For the best accuracy in formatting, consider using income statement templates. Additionally, relying on automated accounting software like Financfy can simplify the process and reduce errors.

FAQs

1.Is an income statement mandatory for all businesses?

The Income Tax Ordinance, 1984 and the Companies Act, 1994, mandate preparing income statements or financial statements for all businesses in Bangladesh. They keep financial records of companies which helps in tax filing.

2. How does an income statement help in business forecasting?

With an income statement, a company can keep track of the profitability trends and set realistic business goals.

3. Who prepares income statements for SMEs?

Accountants or trained business owners generally prepare income statements for SMEs.

4. How often should an income statement be prepared in Bangladesh?

Income statements are prepared monthly, quarterly, and yearly, based on the intensity of transactions of a business. Sometimes, it’s even prepared weekly for internal analysis.

5. Are income statements mandatory for tax filing?

Yes, a company must prepare an income statement for filing returns and taxable incomes.