Businesses are now rapidly shifting towards automation for easy billing. As a result, payment processing speed has increased by 35–40%, while invoicing errors have dropped by around 25% compared to manual methods. All you need is the best billing software in Bangladesh. By using a billing and invoicing software, you can automate invoicing, reduce manual errors, and manage VAT compliance. Additionally, it helps create and manage invoices, track overdue payments, and send reminders to clients.

Here’s Why We Picked These 10 Software Tools:

- Compliant with local regulations

- Feature-rich and easy to use

- Trusted by clients and well-reputed

- Scalable with ongoing support

Key Takeaways

- Billing software automates the entire invoicing process, saving hours and reducing the risks of manual work.

- Invoicing tools generate accurate and professional invoices that match the brand identity.

- Invoicing software offers real-time tracking and handles client payment insights.

- Invoice management simplifies sales, payment, and cash flow in a single integrated system.

- Financfy is one of the best billing and invoicing software in Bangladesh with VAT compliance and automation features.

Top 10 Billing and Invoicing Software (2025)

Let’s have a look at some of the best billing and invoicing software that can help you manage your business finances more efficiently.

| Sl | Software Name | Key Features | Starting Price |

|---|---|---|---|

| 1 | Financfy |

| BDT 4,500 |

| 2 | Zoho Invoice |

| Free |

| 3 | TallyPrime |

| ₹750 |

| 4 | PrismERP |

| BDT 50,000 |

| 5 | Xero |

| $29 |

| 6 | QuickBooks Online |

| BDT 2,316 |

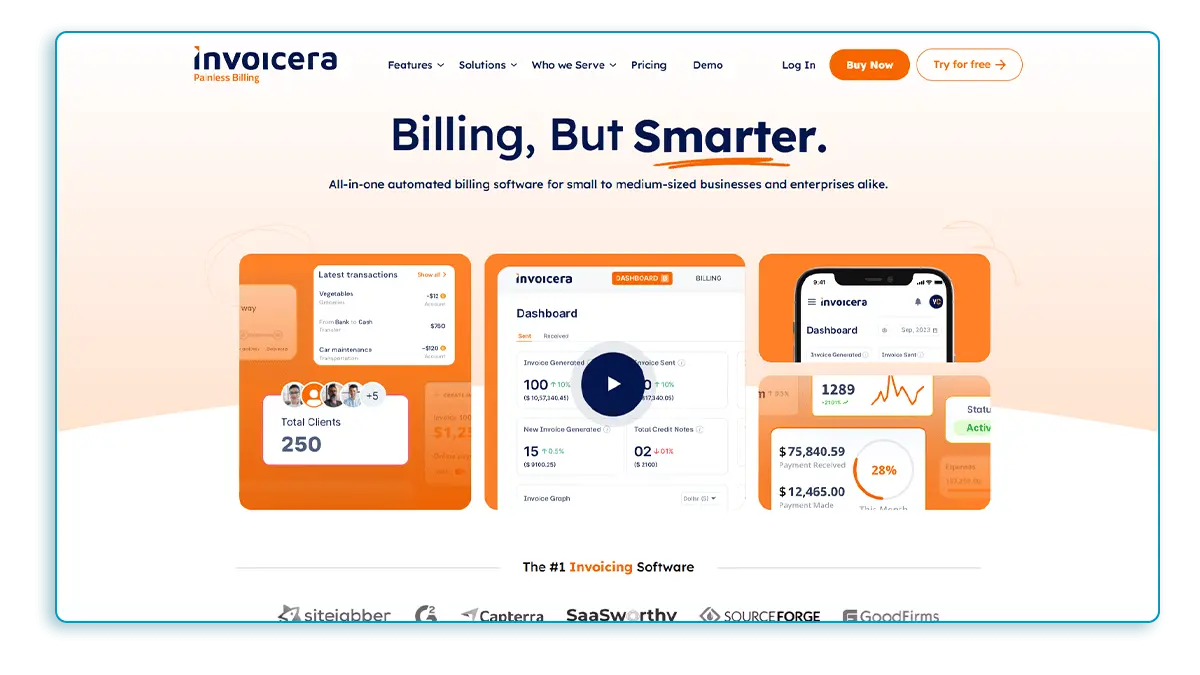

| 7 | Invoicera |

| $15 |

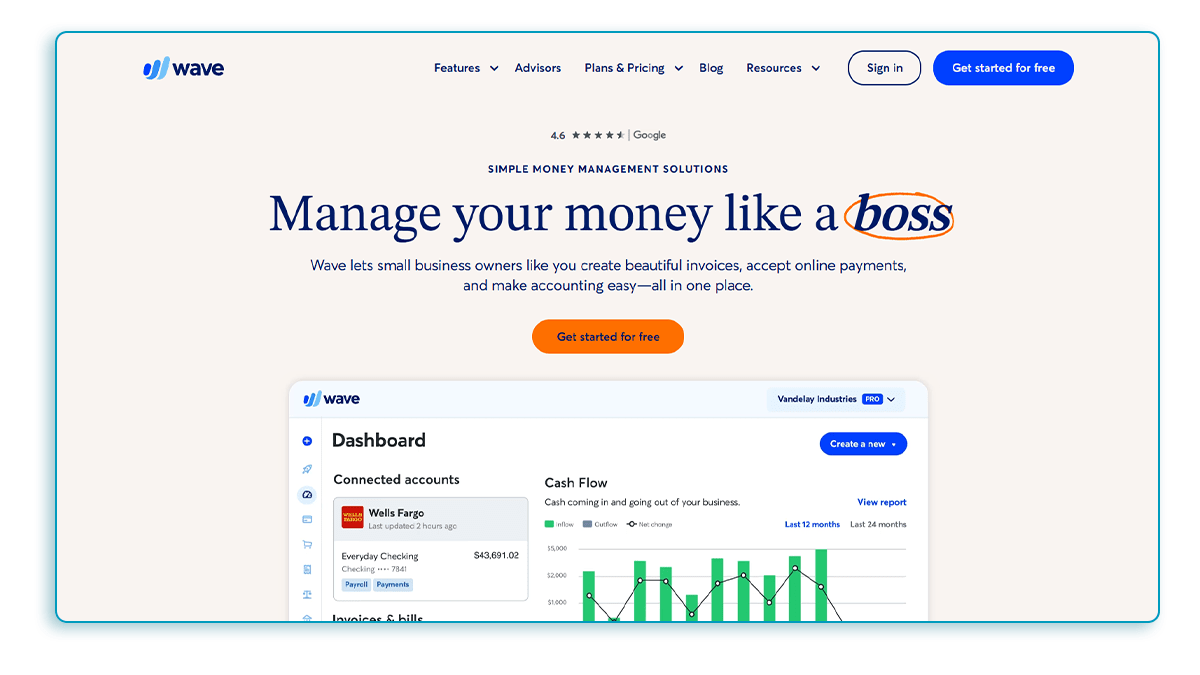

| 8 | Wave |

| Free |

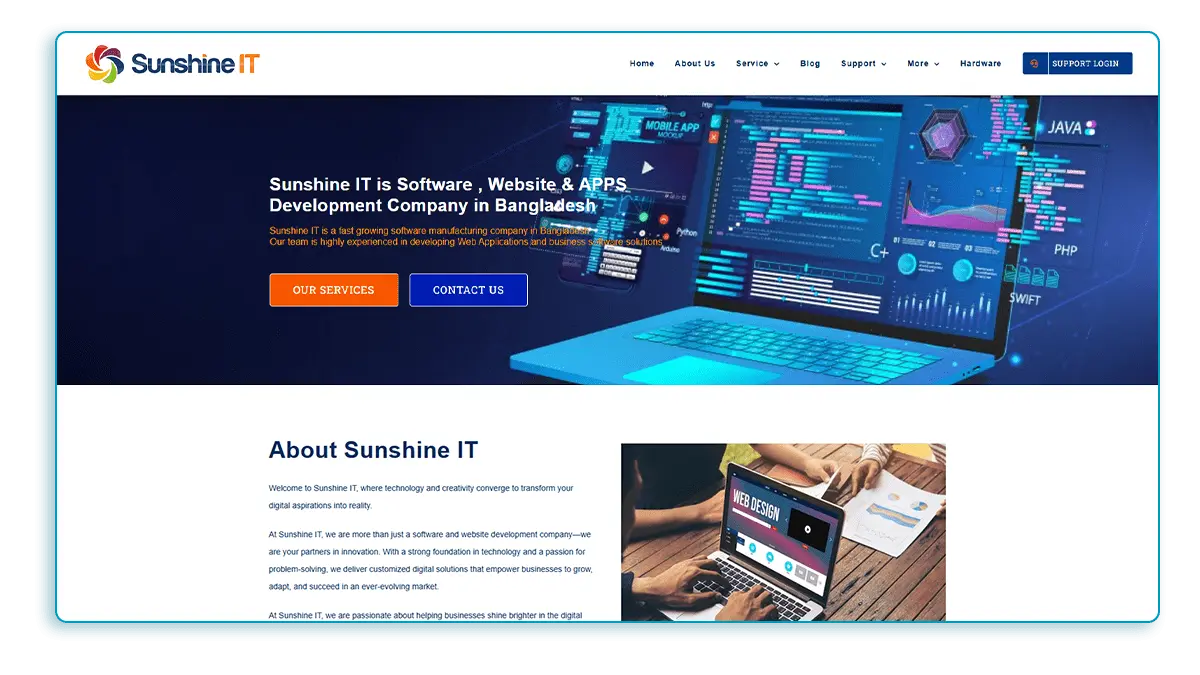

| 9 | Sunshine IT |

| BDT 12,000 |

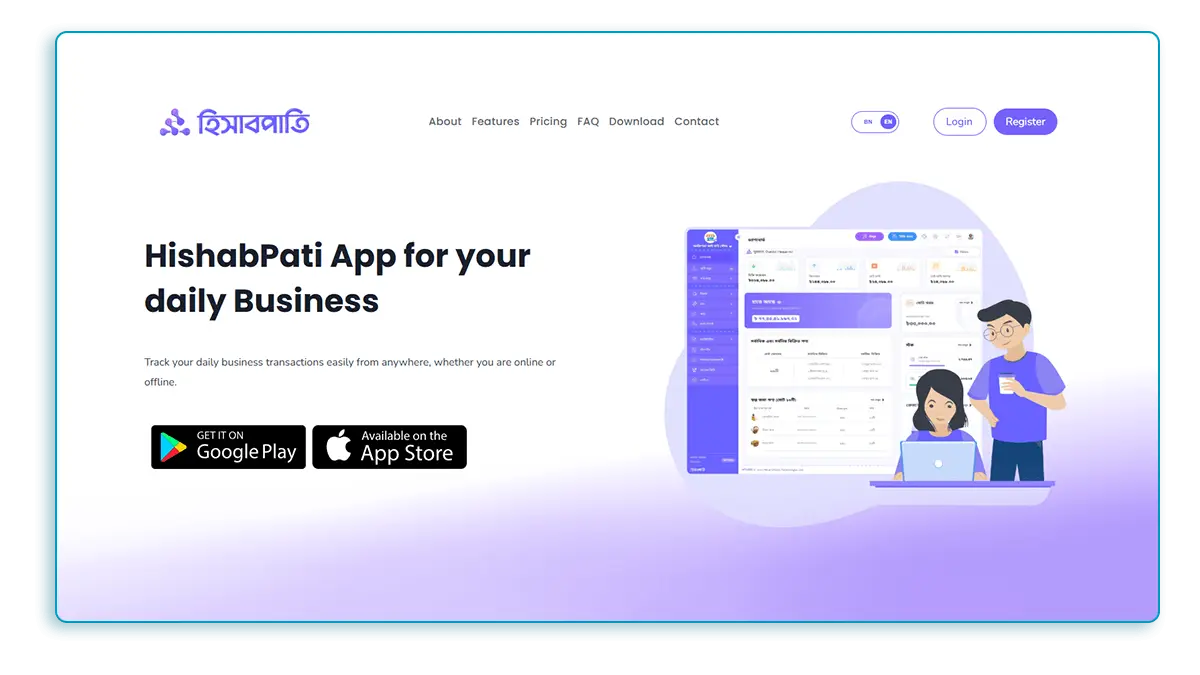

| 10 | HisabPati |

| BDT 99 |

Financfy

Financfy is cloud-based billing and invoicing software designed especially for SMEs in Bangladesh. By using this software, users can easily track invoices, expenses, and payments in real time – all from one platform. Besides its integration features with local payment systems and accounting tools, Financfy offers VAT compliance, automation, and mobile access for smoother operations.

- Key Features: Cloud-based accounting, Real-time reporting, Cash management, Sales management, expense management, Inventory management, Invoice management, Asset management

- Bangladesh Fit: Entirely designed for businesses in Bangladesh.

- Pricing: Starts from BDT 4,500 and goes up to 9,000.

- Rating: 5/5

- Best For: It’s best for SMEs that want authentic cloud-based billing and invoicing software.

| Pros | Cons |

|---|---|

| Offers local support and is NBR compliant. | Has limited support for global currency. |

| Includes AI automation and recurring invoices. | |

| Has secured cloud backups. | |

| Allows multiple users to work on the same platform. |

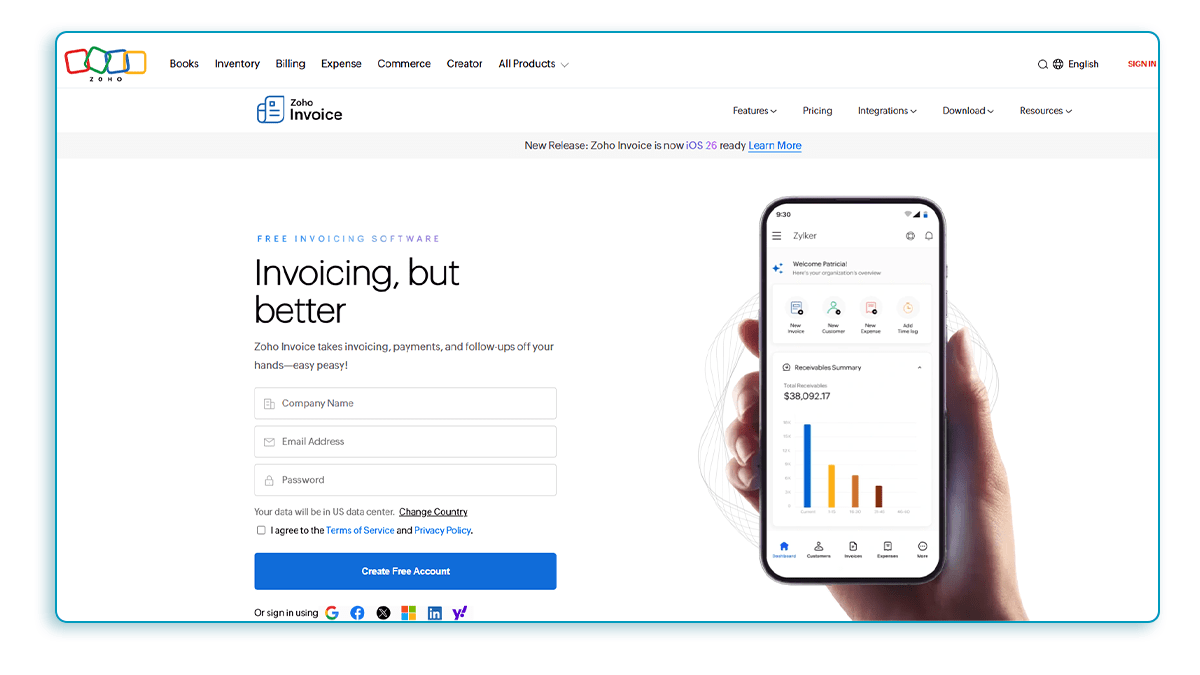

Zoho Invoice

Zoho Invoice is a cloud-based invoice software that can be used globally. It’s mainly designed for small and medium-sized service businesses that need to create professional invoices and manage billing efficiently.

- Key Features: Customizable templates, Multi-currency support, Multi-language support, Digital signature, Recurring invoices, Workflow automation, Sales tax tracking, Payment reminders

- Bangladesh Fit: Designed for global customer base

- Pricing: Free

- Rating: 4.5/5

- Best For: Ideal for startup businesses and freelancers.

| Pros | Cons |

|---|---|

| Small businesses can use it for free. | The VAT setup needs to be done manually. |

| International clients can rely on it. | Doesn't support bulk uploads. |

| Has faster payment features. |

TallyPrime

TallyPrime billing software helps with managing inventory, accounting, payroll, and other business operations. Besides, it has online access, VAT features, and streamlined GST compliance.

- Key Features: Inventory management, Accounting invoicing, GST compliance, Cash flow management, Data security, Online access

- Bangladesh Fit: Less ideal for specific local tax/VAT configurations and payment integrations.

- Pricing: ₹ 750 – ₹ 22,500

- Rating: 4.4/5

- Best For: It’s best for the billing system in Bangladesh that needs to work offline.

| Pros | Cons |

|---|---|

| Available for offline use. | Doesn't have a mobile app. |

| Can handle TDS, VAT, GST, and other tax types. | Beginners can find it challenging. |

| Has strong security features. |

PrismERP

PrismERP is leading ERP software that has a billing and accounting integration tool. It’s IAS compliant and has advanced analytics like financial reporting and AI-driven sales forecasting.

- Key Features: Service layer agreement, Custom billing policy, Notification Templates, Service contract management, Service package management, Subscriber management

- Bangladesh Fit: Moderately suited for Bangladeshi businesses.

- Pricing: BDT 50,000 – BDT 20,00,000

- Rating: 4.3/5

- Best For: Start-ups to large enterprises.

| Pros | Cons |

|---|---|

| Helps with better cost control. | A bit expensive for SMEs. |

| Does precise inventory tracking. | Needs training before using. |

| Provides a single source of data for all departments. |

Xero

Xero invoicing software is cloud-based billing software that can be used globally. Both growing and established companies can use it for invoicing, bank reconciliation, inventory, payroll, and other business applications.

- Key Features: Online invoicing, Expense tracking, Bill management, Project tracking, Bank reconciliation, Payroll, User-friendly interface, Accounting dashboard, Bank connections

- Bangladesh Fit: Moderate

- Pricing: $29 to $69 per month

- Rating: 4.5/5

- Best For: Global clients who need cloud-based invoice software with strong integration.

| Pros | Cons |

|---|---|

| Can be used through the mobile app | Doesn't have the native Bkash link |

| Categorizes bank transactions automatically | Small firms can find it pricey |

| Provides up-to-date dashboards and financial reports |

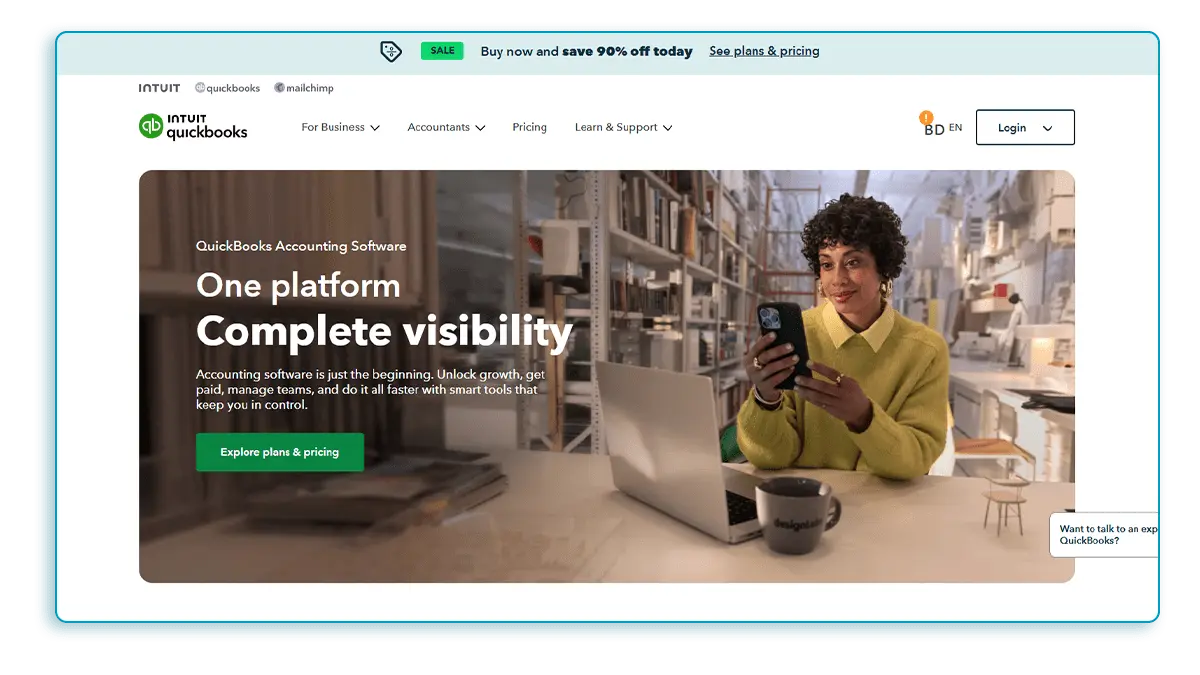

QuickBooks Online

QuickBooks is one of the world’s leading online billing software that helps businesses track income and expenses and manage their finances. It can even integrate with other business management systems, ensuring streamlined operations.

- Key Features: Expense tracking, Bill management, Financial reporting, Time tracking, Project tracking, Tax management, Bank feeds, Cloud-based accessibility

- Bangladesh Fit: Moderate

- Pricing: BDT 2,316 – BDT 9,265

- Rating: 4.6/5

- Best For: Small- to medium-sized businesses can collaborate easily.

| Pros | Cons |

|---|---|

| The cloud system automatically backs up the data | Requires manual setup for local gateways |

| Allows third-party app integration | |

| Can generate and send personalized invoices |

Invoicera

Invoicera is an invoicing software that automates billing tasks for businesses. Such as tracking payments, creating invoices, sending payment reminders, etc. From freelancers to large enterprises, all sizes of businesses can rely on it.

- Key Features: Invoice templates, Auto-matched invoices, Encrypted billing, Integrated payment tracking, Automated invoicing process, Customizable management reports, Real-time billing section, streamlined interface

- Bangladesh Fit: Moderate

- Pricing: $15 to $119 per month

- Rating: 4.3/5

- Best For: Works well for small or large agencies.

| Pros | Cons |

|---|---|

| Saves from late payments with the automated payment reminders. | Its UI is slightly outdated. |

| Can cope with highly customizable invoices. | Needs an integration setup. |

| Can handle multiple currencies |

Wave

Wave is web-based invoicing software that also works as a free online billing software. It has all the essential accounting tools, like invoicing, financial reporting, and expense tracking.

- Key Features: Secure online payments, Painless payroll, Easy invoicing, no-sweat accounting

- Bangladesh Fit: Less suited

- Pricing: Free

- Rating: 4.2/5

- Best For: Freelancers and small businesses.

| Pros | Cons |

|---|---|

| Offers a free plan for basic invoicing and accounting | Customer service can be weak for free users |

| Allows customizable invoices and receipt scanning | Doesn't have advanced features |

| Has free access to unlimited invoices |

Sunshine IT

Sunshine IT is a local POS and billing system in Bangladesh that supports Bangladeshi businesses with invoicing, billing, and digital transaction management. Sunshine IT’s POS system is tailored for Bangladeshi retailers and designed to streamline billing operations.

- Key Features: Quick billing invoice, Product purchase report date-wise, Product return by customer, Daily sales profit loss report, Bank transaction list and report, Daily backup manual and auto, Barcode scanner,

- Bangladesh Fit: Strong Fit

- Pricing: BDT 700 to BDT 20,000

- Rating: 4.4/5

- Best For: Retailers, distributors, and SME traders

| Pros | Cons |

|---|---|

| Makes taxation-related document management easier. | Has limited automation. |

| Offers local support and VAT support. | Can work through the desktop only. |

| Creates invoices in minutes. |

HisabPati

HisabPati billing software is an easy billing software for small business owners in Bangladesh. It supports both online and offline use in Bangla and English. It allows users to access it from desktops, laptops, and mobile devices.

- Key Features: Offline and online access, Data-security backup, Invoicing, User-friendly interface, Inventory and expense management, Outstanding balance tracking, Barcode scanning, Product and party management

- Bangladesh Fit: Strong Fit.

- Pricing: 99 taka to 199 taka per month

- Rating: 4.5/5

- Best For: Small to medium-sized businesses requiring a mobile-friendly platform that supports both online and offline operations.

| Pros | Cons |

|---|---|

| Can create both simple and colorful invoices. | Has fewer customization options. |

| Invoices can be generated from both the mobile app and the web version. | Has limited export features. |

| The price is very low. |

A Quick Comparison of the Best Billing and Invoicing Software

Let’s compare all the software to help you decide at a glance.

| Software Name | Compatibility | Ease of use | Customer support | Integration capabilities | Ratings |

|---|---|---|---|---|---|

| Financfy | Cloud-based and accessible via mobile and web | Modern and simple dashboard with quick navigation | 24/7 live chat and local Bangladeshi support | Integrates with Bkash, Nagad, Rocket, POS, etc. | 5/5 |

| Zoho Invoice | Web and mobile app for both Android and iOS | Very intuitive and has a minimal learning curve | Email, live chat | Zoho Books, PayPal, Stripe, G Suite | 4.5/7 |

| Tally Prime | Windows desktop and cloud access portals | Has a familiar tally UI and a modern learning curve | Global partner and reseller network | Excel, VAT/GST modules, CRM & BI tools | 4.4/5 |

| PrismERP | Cloud and on-premise | Has a rich interface with some complexity | Premium support for both on-site and off-site | POS, payment, SMS/email billing, HR, and CRM | 4.3/5 |

| Xero | Fully cloud-based, which works in web and mobile | Has a clean and professional interface | Email, community, and ticket system | 1000+ app integrations, including PayPal and Shopify | 4.5/5 |

| QuickBooks Online | A cloud that has web and mobile access | Requires a simple setup that's beginner-friendly | Live chat, phone, and community support | PayPal, bank feeds, POS, CRM | 4.6/5 |

| Invoicera | A cloud-based web platform | Invoice editor and template systems are smooth | Email and live chat | 30+ payment gateways and accounting apps | 4.3/5 |

| Wave | Accessible through the web and mobile | It is very intuitive and beginner-friendly. | Email and chatbot help centre | Bank feeds, Stripe, Wave Payroll | 4.2/5 |

| Sunshine IT | Accessible through the web and Windows | A simple interface with a Bangla language option | Training on both phone and on-site | Bkash, Nagad, POS printers | 4.4/5 |

| Hisab Pati | Web-based, but also responsive to mobile | Minimal dashboard with easy navigation | Hotline and local tech support | Bkash, accounting ledgers, and POS | 4.5/5 |

How to Choose the Best Billing and Invoicing Software for Your Business?

Consider the following factors while choosing billing and invoicing software best suited for your business.

- Localization & VAT Compliance: The billing software should support Bangladeshi currency (BDT) and comply with NBR regulations. It should also be capable of handling recurring invoices and partial payments.

- Automation & Recurring Billing: Check if the software includes payment reminders, expense tracking, and invoice generation. Auto-payment integration and partial payment support are also essential features.

- Integrations & POS Linkage: Choose software that allows integration with online payment gateways, sales management systems, and POS tools like barcode or product management modules.

- Customization & Mobility: Opt for solutions that offer custom invoice templates, user roles and permissions, and mobile app functionality. Multiple users should be able to access and manage data easily from anywhere.

- Scalability & AI Insights: The software should support growing transactions and key modules like CRM, payroll, or inventory management. Modern billing solutions may also offer AI-driven insights from billing and payment history.

Why Businesses Should Look for Billing and Invoicing Software?

Billing and invoicing software can make your business operations much easier. Here are some of the reasons why businesses should use it.

- Saves time: Automated invoicing, billing, and payment reminders reduce errors and save valuable time.

- Reduce human errors: Automation and templates ensure your financial records of businesses stay accurate and error-free.

- Get faster payments: Integration with online payment systems and recurring billing speeds up the payment process.

- VAT compliance and accurate reports: VAT-compliant invoices, audit trails, and accurate BDT transactions ensure your financial records meet regulatory standards.

- Improved customer experience: With professional invoices, error-free billing, and faster delivery, customers get their bills promptly and accurately.

- Streamline sales, expenses, and cash flow: Sales management, expense management, and cash flow management are depicted in one integrated platform.

- Scale easily as your business grows: Easily scalable, as it handles growing transaction volumes, supports multiple users, and integrates seamlessly with other tools.

Note: Many Bangladeshi businesses still rely on manual billing and invoicing, leading to higher error rates, late payments, and compliance risks. Adopting an automated billing software ensures faster cash flow management, VAT filing, and accurate financials.

Future of Billing & Invoicing Software

The AI accounting market in Bangladesh is evolving. It has now enabled smarter, faster, and more secure billing, which will improve more in the future.

Practical LLM Uses Today

Large Language Models (LLM) are like GPT-based AI systems. They refer to the real and usable applications of AI language models, making billing and invoicing more automated and human-like.

- Smart line-item suggestions: Automatically suggests products, applies pricing and taxes, and provides context-aware recommendations.

- Anomaly & fraud hints: Quickly identifies unexpected deviations and potential fraudulent activities.

- Natural-language queries: Ask questions in plain language and receive instant, data-driven reports.

- Auto-compose reminders: Automatically sends reminders for upcoming or overdue invoices via email, SMS, or mobile app notifications.

Governance

AI first automates tasks such as invoice suggestions, anomaly detection, and reminders, while humans review and approve actions. This makes it easier to trace, verify, and report financial activities. Also, the handling of Personally Identifiable Information (PII) ensures data is securely stored and protected from unauthorized access.

Local Nuance

Billing and invoicing software in Bangladesh accommodates country-specific formatting, including date formats, VAT lines, and currency symbols. For example, invoices and reports follow Bangladeshi date conventions, display VAT clearly on each line, and show amounts in Bangladeshi Taka (৳). These features ensure strong compliance with local regulations while making financial documents easier for local users to read and understand.

Why Financfy is the Best Billing and Invoicing Management Software in Bangladesh?

Financfy is premier billing and invoicing software tailored for Bangladeshi businesses. It offers professional invoicing, automated reminders, VAT compliance, multi-currency support, and real-time reporting, making financial management easier for SMEs. Financfy is cloud-based billing and invoicing software allowing access from anywhere. In fact, business owners can use its intuitive mobile app to manage finances remotely or on the go.

Here’s what Financfy offers:

- Multiple invoice flow (sales order → invoice)

- Automated billing

- Credit Notes from Invoice

- Recurring Estimate and Invoice

- Real-time analytics

- Cloud & data security

- Scalable for SMEs

- Local support

Conclusion

In 2025, the best billing and invoicing software in Bangladesh combines cloud-based efficiency, automation, and regulatory compliance. These reduce errors while simplifying financial management for businesses.

Financfy remains the leading billing software in Bangladesh, trusted for its local support, automation, and scalability. Businesses choosing Financfy can scale smoothly and manage operations more efficiently.

FAQs

1. Which invoice software supports BDT and Bangladesh VAT?

Financfy, HisabPati, and PrismERP all support Bangladeshi Taka (BDT) and comply with VAT regulations under the NBR, making them suitable for local businesses.

2. Does billing software work with bKash/Nagad?

Yes, billing software like Financfy can integrate any payment gateway in bangladesh with bKash and Nagad, allowing businesses to accept mobile payments.

3. Can I make Bangla invoices?

Yes, you can make Bangla invoices with Financfy and PrismERP. Both platforms support Bangla fonts and local formatting standards for professional invoicing.

4. What are the costs for small businesses?

For small businesses, billing and invoicing software typically costs between BDT 1,000–5,000 per month, depending on features and number of users. Many platforms like Financfy also offer flexible plans or free trials suitable for startups.

5. How do reminders and late fees work?

Billing software automatically sends payment reminders to clients before or after the due date. Users can configure the schedule of reminders via email or SMS to alert clients. For overdue payments, the software can calculate and add late fees automatically according to your configured rules.

6. Is my data secure and backed up in Bangladesh?

If you are using cloud-based billing software like Financfy, it will surely secure your data through encryption and local backups.